For this purpose, the government is just not interested whether you are purchasing precious metals or fertilizer, only that you plunked down "dollars."

A self-directed IRA can be a tax-advantaged account that offers you far more flexibility as compared to an IRA managed by a broker and also comes along with a A great deal increased chance of ruining your retirement savings.

Work on your retirement strategy having a economic advisor by your aspect. Get matched to an advisor in minutes.

This informative article cites guidelines and polices that were legitimate at the time it had been published. Readers are encouraged to examine the references at any law library to make certain they remain legitimate. This informative article does not offer you legal assistance.

By clicking “Accept All Cookies”, you comply with the storing of cookies on your own system to enhance site navigation, analyze web site use, and aid in our internet marketing efforts.

Once you figure out wherever you need to open a self-directed IRA, you can pick which different investments you need to purchase. Whenever you’ve settled on your alternative asset lessons, you might require to Track down a respected dealer to get from, especially if your custodian doesn’t have now-founded partnerships.

Not all IRA companies present self-directed accounts. Among those who do, charge structures and feature sets could vary significantly. The best self-directed IRA custodian for you personally will be the one that is not difficult to be aware of and serves your distinct requires at an affordable price.

A vital difference between a traditional as well as a Roth IRA is that every requires you to pay taxes at distinctive periods. With common IRAs, you have an up-entrance tax break, but you pay taxes on the contributions and earnings published here as you withdraw them, customarily for the duration of retirement.

Unique retirement accounts (IRAs) are savings accounts meant to provide a supply of earnings for retirement.

For anyone hoping to finance their retirement with assets it is possible to’t find at a conventional brokerage, self-directed IRAs is usually an attractive option. But even when that describes you, you ought to even now commence with caution.

A self-directed IRA may be a minimal tougher to build than a standard IRA, but numerous investors discover the freedom is definitely worth the extra function.

Most effective credit rating cardsBest credit card reward offersBest stability transfer credit rating cardsBest journey credit cardsBest dollars back again credit history cardsBest 0% APR credit cardsBest benefits credit cardsBest airline credit history cardsBest faculty scholar credit cardsBest bank cards for groceries

In case you violate the prohibited transaction procedures, the IRS can strip your account's IRA standing. Which is treated as being a taxable distribution of all assets in the account as of January 1.

A self-directed IRA is like a standard IRA in almost every way, with the key difference staying what it might put money into. Buyers can choose from two main types:

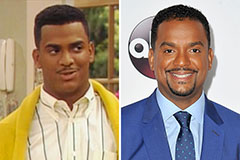

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!